IPI in 2025: What It Is, Why It Still Matters, and How to Raise It (Fast)

Many sellers think IPI “went away” after COVID. It didn’t. IPI (Inventory Performance Index) is Amazon’s 0–1000 score of how efficiently you run FBA inventory. It’s still used to gate storage capacity and some program perks (e.g., FBA New Selection uses a minimum IPI for eligibility).

Quick definition: IPI measures how you manage excess inventory, sell-through, stranded inventory, and in-stock rate for replenishable ASINs. Those four levers are the playbook.

🧭 Where to see it (and what’s “good enough”)

- Find your IPI in Seller Central → Inventory → Inventory Performance (dashboard).

- Historically, many marketplaces treated ~400+ as the “safe” zone to avoid tighter limits; Amazon hasn’t published a universal live threshold for all regions, but keeping IPI well above ~400 is common industry guidance. Always rely on your dashboard’s guidance and color bars.

Why you still care: Since 2023, Amazon sets monthly capacity limits. IPI remains one of the inputs Amazon considers when setting your limit. Better IPI → generally better capacity flexibility.

🧩 The 4 IPI levers (and exactly how to pull them)

🚦 1) Sell-through (make stock move)

What it is: Units shipped (last 90 days) ÷ average FBA on-hand units (same period). Higher is better.

Targets: Many brands aim for ≥3.0 as a healthy baseline (category-dependent).

Moves you can make this week

- Turn on deals/coupons for slow movers; push SP exacts on converting queries; add SB Video for top non-branded terms (controlled spend).

- Bundle or multi-pack to lift unit velocity.

- Lower price to the next psychological break if margin allows (e.g., $24.99 → $22.99).

Worked example (sell-through)

- 90-day units shipped = 1,350

- Avg FBA on-hand (same period) = 450

- Sell-through = 1,350 ÷ 450 = 3.0 (good)

📦 2) Excess inventory (cut the dead weight)

What it is: Units Amazon flags as more than demand warrants (often >90 days of cover). Excess hurts IPI and bleeds storage fees.

Moves

- Action slow SKUs: price drops, coupons, Outlet deals, targeted ads, or FBA Liquidations/Removals when economics say “stop.”

- Inbound discipline: pause POs; ship smaller, more frequent replenishments on slow movers.

Mini math: If SKU A sells 2/day and you hold 400 units → 200 days of cover → likely “excess.” Trim to ≤90 days (~180 units).

🧵 3) Stranded inventory (fix listings = free IPI points)

What it is: Sellable units at FBA but not buyable (listing suppressed, missing offer, etc.). You’re paying storage for items that can’t sell.

Moves

- Daily “Stranded” check → relist, fix ASIN condition, update compliance bullets/images, request reactivation.

- If a fix isn’t viable, create removal (or liquidate) to stop paying to store it.

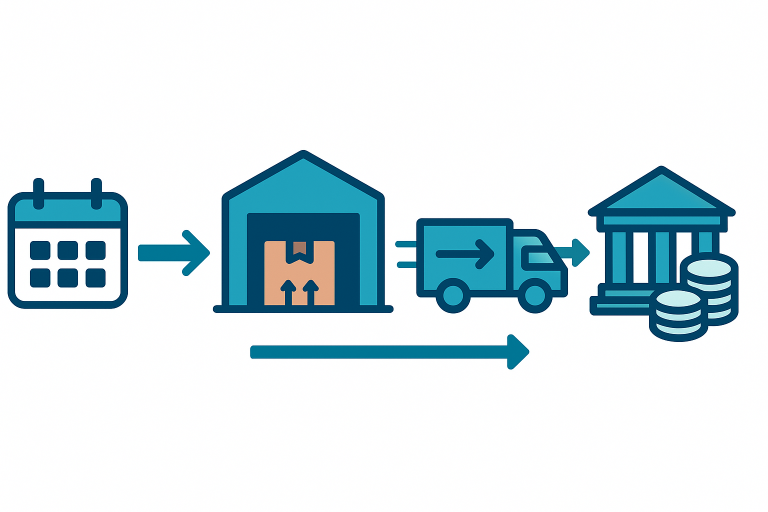

🔁 4) In-stock rate (for replenishable ASINs)

What it is: How consistently you keep replenishable best-sellers in stock. Frequent OOS drags IPI.

Moves

- Replenishment rules by SKU class (i.e. order of importance, classified as A SKU/B SKU/C SKU) and lead time; use buffer stock for A-SKUs.

- Consider AWD feeding FBA (auto-replenish) to stabilize regional stock and promises. (Program availability varies; check your marketplace.)

- If a SKU is truly non-replenishable, mark it so—you won’t be penalized for not restocking discontinued items.

🧪 Quick “IPI Boost” 7-day plan (repeat weekly)

- 🛑 Clear stranded (5–10 min): Fix what can sell today; remove what can’t.

- 📉 Trim excess (15 min): Sort FBA inventory by days of cover; for >90 days, take one action (price, coupon, ad nudge, removal/liquidation).

- 🚀 Raise sell-through (15 min): Push the top 5 slow movers with the best contribution margin (deal + SP exact; small budgets).

- 🔄 Protect in-stock (10 min): Check A-SKUs with ≤14 days cover; create replenishments or enable AWD feed if you use it.

- 📊 Read IPI Monday: Track the score weekly; the four sub-metrics update daily, the headline often weekly.

🧮 Worked example: “Will a price drop beat storage fees?”

SKU B

- Units in FBA: 300

- Daily sales: 1.5/day → 200 days of cover (excess)

- 30-day storage cost/unit: $0.06 (std-size example) → ~$18/month total

- Ad-free gross margin/unit at $25: $7.80

- If you drop to $23 and add a $1 coupon, modeled CVR lifts → sales pace to 3/day (industry rule-of-thumb test)

Result:

- Days of cover drops from 200 → 100 (close to target)

- Extra 45 units/month sold; storage avoided and IPI improves via sell-through ↑ and excess ↓

- Margin hit = ~$1.70/unit × 45 = $76.50 vs. time-decay storage + risk of aged fees—worth it for 60–90 days to exit excess.

(Fee numbers vary by size tier/marketplace—always plug current rates.)

🤔 “Wasn’t IPI abolished after COVID?”

No. Amazon changed how limits are assigned (to monthly capacity limits starting Mar-2023) but IPI remains:

- It’s still the core “inventory health” measure Amazon uses and influences capacity.

- Some benefits/programs (e.g., FBA New Selection) explicitly reference IPI (e.g., ≥300 for eligibility in 2024).

- Many reputable sources and ops guides in 2025 still treat ~400+ as a safe IPI, though Amazon’s dashboard is the ground truth.

🧯 Common IPI myths (and the reality)

- “IPI updates daily.”

Reality: The headline IPI often updates weekly, while the four inputs move daily. - “IPI doesn’t affect me now that limits are monthly.”

Reality: Capacity limits consider IPI, forecasts, lead times, and FC constraints. - “Excess is just ‘too much inventory’.”

Reality: Amazon flags “excess” relative to demand (commonly >90 days cover).